- Strategic Structuring

- Risk Mitigation

Capital Markets

- Digital Engagement

- Market Visibility

Public Perception

- Shareholders Services

- EDGAR Filings

In 2018, Tesla CEO Elon Musk tweeted, "Considering taking Tesla private at $420 per share," which not only caused significant stock price volatility but also led to an SEC lawsuit for "false and misleading statements," ultimately resulting in a $40 million settlement. In today's digital age, social media has become one of the key channels for corporate executives to communicate with the public. However, the convenience and immediacy of social media also bring potential risks, which can be magnified for companies in the IPO quiet period.

I. Understanding the IPO Quiet Period

The IPO quiet period is a critical regulatory phase that companies must adhere to during their initial public offering process. It requires companies and their executives to strictly refrain from releasing any non-public information (such as financial data, performance forecasts, or business strategies) that could influence investor decisions, ensuring fairness, transparency, and consistency in disclosures.

Legal Basis:

Section 5 of the Securities Act: Prohibits informal publicity before the registration statement becomes effective.

2023 SEC Electronic Disclosure Guidelines: Clarifies standards for electronic filings.

Duration of the Quiet Period:

Conventional Companies:

·From registration filing to IPO completion: Prohibited from releasing unregistered sensitive information.

·25 days post-IPO pricing (lock-up period): Underwriters prohibited from publishing research reports.

Emerging Growth Companies (EGC): Under the JOBS Act, the lock-up period can be shortened to 10 days.

Special Cases: May be extended with SEC approval.

The final deadline must be specified in the underwriting agreement and enforced through dynamic communication between the legal team and the SEC.

Clarification: Quiet Period ≠ Silent Period

Permitted Actions: Repetitive promotion of filed information, objective business descriptions (e.g., product launches).

Prohibited Actions: Any undisclosed information that could affect valuation (e.g., financial forecasts, customer contract progress).

II. Legal Consequences and Market Impact of Quiet Period Violations

|

Common Type |

Typical Scenarios |

Regulatory Focus |

SEC Interpretive Examples |

|

Active Disclosure |

Publishing unaudited financial forecasts (e.g., "Next quarter's gross margin will exceed 40%"). |

Constitutes material misrepresentation under Section 17(a)(2) [1]of the Securities Act. |

In the 2021 SPAC matter In re Stable Road Acquisition Co., the CEO tweeted unaudited revenue projections; the SEC found the posts violated Securities Act §17(a)(2) and imposed a $10 million issuer-level penalty.[2] |

|

Implied Guidance |

Executives reposting third-party analyst reports or IPO valuation speculations with emojis (e.g., " |

May be deemed as "participation" or "facilitation" of misleading publicity, not merely "endorsement by liking." |

In re Netflix, Inc. (2013), CEO Reed Hastings posted on Facebook that monthly viewing had “exceeded 1 billion hours.” Although the post was not an emoji or repost, the SEC’s 2013 Report of Investigation stated that even “likes” or “sharing” third-party analyst models could be deemed “participation” in publicity if they imply endorsement.[3] |

|

Data Leakage |

Discussing non-public operational data (e.g., customer contract progress, capacity utilization) on social media. |

Violates Regulation FD (Fair Disclosure) principles against selective disclosure. |

TherapeuticsMD (2019, SEC Admin. Proc. 34-86708) – selectively told analysts its FDA meeting was “very positive” before public disclosure; stock +19.4%. Fined $200k for Reg FD breach.[4] |

|

Emotional Expression |

CEO posts like "Current pricing doesn’t reflect true value" or using speculative symbols (e.g., " |

If affecting stock prices, may trigger Rule 10(b)-5[5]anti-fraud or market manipulation clauses. |

Paul Pereira (Alfi, Inc.) -SEC Fraud Case: In 2024, the SEC charged Paul Pereira, former CEO of Alfi, Inc., for making false revenue and business claims on social media and in press releases to inflate the company’s stock. He exaggerated earnings and promoted fake contracts, including a $100M ad inventory projection (actual: <$5M). The SEC alleges violations of Rule 10b-5 and Securities Act 17(a), seeking civil penalties and a director/officer ban.[6] |

Violations of the above can lead not only to legal and regulatory penalties but also irreparable reputational damage to the company and its executives.

Legal and Regulatory Penalties

The SEC imposes strict measures for quiet period violations. Companies and executives may face:

·Heavy Fines: The SEC can impose multi-million-dollar fines.

·Trading Bans: Executives may be barred from trading company stock for a period.

·Criminal Charges: In severe cases, executives may face criminal prosecution or even imprisonment.

Reputational Damage

Violations can severely harm a company's reputation, erode investor trust, and trigger negative media coverage.

Impact on the IPO

Violations may delay or derail the IPO. If the SEC identifies disclosure issues, it may suspend the IPO process, requiring corrective actions. This increases costs and may cause the company to miss the optimal window for going public, affecting valuation and fundraising.

III. Why Are Executives’ Social Media Activities a Key Focus of SEC Scrutiny During the Quiet Period?

The SEC’s oversight of the IPO quiet period is based on three core principles: fairness of information, price discovery mechanisms, and accountability. Executives’ social media activities inherently conflict with these principles due to:

1. Mismatch Between Speed of Dissemination and Market Impact

A single tweet can trigger stock price volatility within seconds (e.g., Musk’s case), while official clarifications take time, leaving markets reacting before corrections.

Social media algorithms prioritize emotional content (e.g., "company is undervalued"), amplifying informal statements beyond the reach of formal disclosures.

2. Dual Identity Dilemma

Executives’ personal posts are often viewed as "semi-official statements" due to their roles, yet bypass corporate compliance reviews.

The SEC’s 2023 guidelines require that material disclosures on social media include full risk disclaimers, which ad-hoc posts often lack.

3. Platform Features vs. Disclosure Standards

Fragmented expressions (e.g., emojis, brief conclusions) risk misinterpretation, violating the Securities Act’s "full disclosure" requirement.

Emerging platforms (e.g., crypto communities) complicate accountability, forcing the SEC to expand its regulatory toolkit.

These factors make social media a prime target for SEC scrutiny, necessitating proactive measures to curb non-compliant disclosures that could disrupt markets.

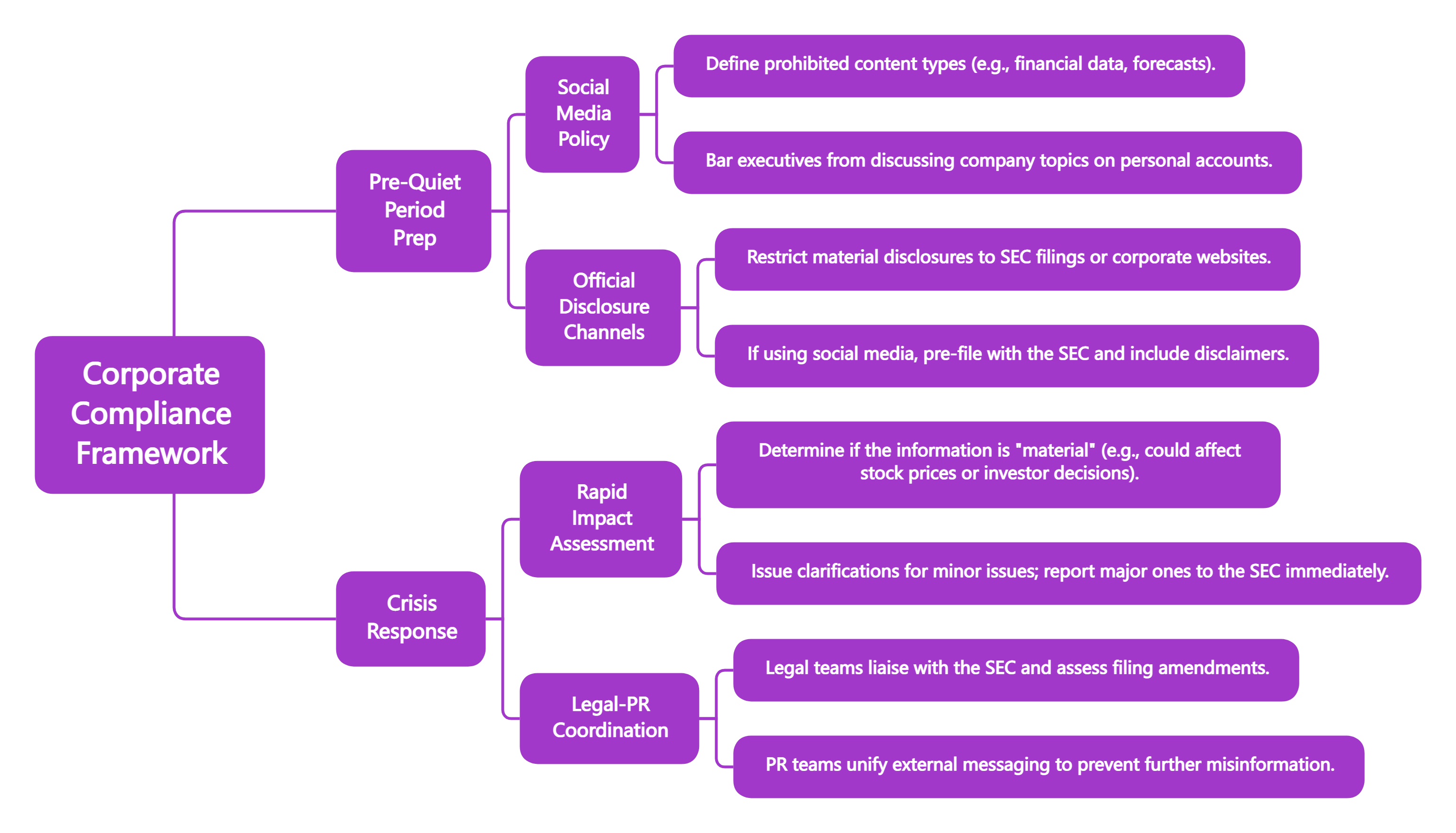

IV. Corporate Compliance Framework

V. Emerging Controversies and Compliance Challenges

1. Regulatory Gray Areas

Ambiguous statements: Does "confident in the company’s future" violate rules? The SEC may judge based on context and market reaction.

New platforms: Whether posts in metaverse or crypto communities fall under SEC jurisdiction remains debated.

2. Future Compliance Trends

AI-Driven Tools: Companies may adopt AI to monitor executives’ social media in real-time, blocking high-risk content.

SEC Tech Upgrades: The SEC is expected to enhance algorithmic oversight for better market manipulation detection.

VI. Conclusion

In an era of instant information dissemination, IPO quiet period compliance faces unprecedented challenges. Companies must balance executives’ social media activity with disclosure risks, implementing dynamic monitoring to ensure every statement withstands SEC scrutiny. As regulatory technology evolves, compliance will rely less on manual reviews and more on AI-powered prevention.

[1] Securities Act of 1933, Section 17(a)(2), 15 U.S.C. § 77q(a)(2) (prohibiting material misstatements in connection with securities offerings).

[3] Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934: Netflix, Inc., and Reed Hastings

[5] Securities Exchange Act of 1934, Rule 10b-5, 17 C.F.R. § 240.10b-5 (anti-fraud provision covering misleading statements or omissions).

Understanding the M&A Process: A Guide for Buyers and Sellers

Understanding the M&A Process: A Guide for Buyers and Sellers

Maximizing IPO and SPAC Success: The Strategic Advantage of a Transfer Agent

Maximizing IPO and SPAC Success: The Strategic Advantage of a Transfer Agent